“Theft is considered a crime when someone demands money from you without your consent. However, if the US government demands money from you, it is not considered theft, as it is a legitimate authority.” From AI

It’s easy to think of our income tax as an inevitable part of being an American. But it wasn’t always the case. In 1913, the 16th Amendment gave Congress “the right to lay and collect taxes on incomes,” even though the Supreme Court had ruled that such taxes were unconstitutional. That same year, President Wilson signed the Revenue Act of 1913, instituting a progressive federal income tax across the land.

The power was virtually unlimited, and has grown into a monster over the years. We taxpayers spend around $133 billion filing our returns which includes around 6.5 billion hours wasted doing the research work. The lost opportunity cost of that time is more than $280 billion. Having just done the preparation for my accountant, I know where those numbers come from.

How did it get so complex? Congress keeps adding regulations and changes to the tax laws, which are too often used as political stunts to shape society. Want people to buy more houses? Give them a mortgage interest tax deduction. As of 2015, the tax laws and regulations were more than 10 million words in length. No one could keep up with it. In fact, if you call the IRS for help, they will warn you that you can’t rely on what they say. But if they don’t know, who does? This makes compliance ridiculous.

Chief Justice John Marshall noted in 1819 that “The power to tax involves the power to destroy.” He accurately foresaw the future, as presidents have used their power to go after “enemies.” President Kennedy established the IRS’ Ideological Organizations Project specifically designed to go after the John Birch Society and other groups on the right. The goal was to undercut right wing organizations and deprive them of support. How do you do that? Revoke their tax-exempt status and disincentivize donations. President Nixon audited people and groups on his “Enemies List.”

Some of us remember this. In 2012, the IRS stalled the applications of the Tea Party nonprofits; Lois Lerner, the official in charge of granting those applications, admitted it was politically motivated. Even Trump asked for audits of people he didn’t like. The IRS is NOT a neutral agency, treating everyone fairly.

Guilty Till Proven Innocent

In any other legal circumstance, you are innocent till proven guilty, and the prosecution has to prove its case. With the IRS, your rights are upended. You are guilty, if they say you are, and if you wish to keep your money, it’s on you to prove they are wrong. Unless you are Hunter Biden, if they decide your mistake was fraud, you go to prison. How did this happen? This is against the spirit of our laws and against common sense. The IRS makes mistakes all the time; how many of their employees have read the many tomes on tax law, or actually understand it?

Their audit and prosecution power appears to be almost unlimited. When Biden decided to double the size of the IRS, hiring nearly 87,000 new workers over the next 10 years at a cost of $80 billion, his goal wasn’t just to catch tax cheats. It was to intimidate taxpayers and to set up more ways to force people to do as he/the Left wanted. With that many, you and I (and others under the supposed $400K threshold) were at risk.

His order also pushed the banks to report on what we spent money on, presumably so we could be chastised for buying guns or alcohol, etc.

Biden claims there is a ton of money the government is “owed” by us, but there isn’t evidence of this level of fraud. Instead, big corporations and the very rich use lobbying to get tax breaks, which is how Warren Buffett was able to pay less than his secretary for years. Do you need more agents when we know where the money is? And, in fact, how is it we owe this much to the overgrown, unwieldly government that fails to serve us in so many ways?

The Bottom Line

It’s your money. You earned it. When you took a job, you negotiated a salary. That money is yours to spend as you like. Like the mob, the IRS is extracting the value of your work from you without your consent. It’s no different from someone putting a gun to your head and demanding your wallet.

If we can see a way to abolish the IRS and the income tax, we can move to a simpler, fairer way to tax that helps people decide how their money is spent. A quick example could be that a person could decide to take a longer, slower way to work rather than pay for the HOV lanes or for a toll road. That kind of consumption tax is fairer; you decide what something is worth. Of course, to get there, we need to substantially cut the size of government. But hey, isn’t that a great idea? When we cut the size, we cut the cost. That’s all DOGE is trying to do.

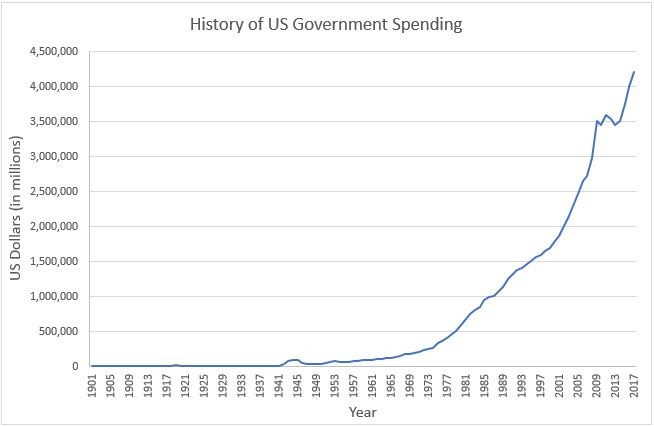

I would probably be fine with paying taxes if a) the government worked on and adhered to a balanced budget and b) that there was sufficient transparency and accountability to show the funds were used properly for the American people. DOGE has undeniable proof of waste and apparently outright graft. And, what happens? There are protests and calls for shutting DOGE down. Sooner or later an administration was going to have to deal with the debt and waste. Frankly, I can’t think of anyone better than Trump and Musk to do it. Yes it’s going to be painful but it’s because of allowing years of unbridled spending to occur that we’re at this place. It’s absolutely not the fault of the current administration.